California Corporate Tax Collections Lag Estimates

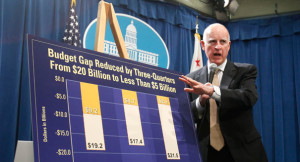

It’s a litany of good news in Gov. Jerry Brown’s election-year budget. Safety net programs are being shored up. Debt is being repaid. Revenues are rising.

Except for corporate taxes.

In fact, business tax receipts are falling at the same time hefty profits are being posted by major companies across the country.

Partly, the lagging revenues are due to the variance between tax years, which cover a calendar year, and California’s fiscal years, which run from July 1 to June 30. But primarily the sluggish and mercurial business tax receipts stem from policy changes enacted, starting in 2008, by the Democratic Legislature and Republican Gov. Arnold Schwarzenegger.

“With all the changes by the state in the formulas, the effective corporate tax rate has bounced around for a variety of companies,” said Loren Kaye, president of the California Foundation for Commerce and Education, a think-tank affiliated with the California Chamber of Commerce.

“There have also been different factors in different years that contribute. During the recession there weren’t profits to be taxed,” Kaye said. “Being able to carry forward your losses was suspended for a few years, which caused some taxes to go up. Now it’s been reinstated and that will probably cause profits to be offset for a few years. The effect of all those things has been to flatten what would have been more of a cycle. “

At $8 billion this year, the taxes collected from most of California’s major businesses are $4.4 billion less than what they were in the fiscal year that ended June 30, 2005.

In 2003, the Franchise Tax Board reported that corporate taxes were less than they were in 1985, when adjusted for inflation.

“Since 1988, California corporation tax revenues grew much more slowly than both the California economy and other major sources of California revenue,” writes Allen Prohofsky in his 2003 Trends in California Corporation Tax Revenues. “In fact, inflation-adjusted corporation tax revenues actually declined.”

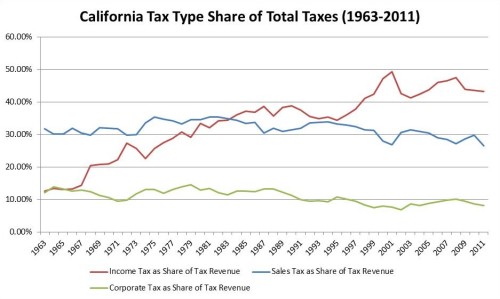

Corporate tax revenue grew by 6 percent over the 25 year period Prohofsky studied while personal income tax grew by 245 percent and sales tax by 108 percent. Prohofsky says that, not unlike today, the chief reasons for the lagging corporate collections were “directly attributable to policy decisions made by the California Legislature” – and the governors who signed those policy changes into law.

The current corporate tax rate is 8.84 percent.

Echoing both Kaye and Prohofsky, the Legislative Analyst describes business tax receipts as “depressed,” in its most recent Fiscal Outlook and says past budget fixes are a factor.

“The weakness in California (corporate tax) collections is partially the result of budget actions passed by the Legislature in recent years to collect revenues earlier and delay the use of certain tax credits and deductions. These measures had the net effect of moving revenue forward … from future years. While the effects of some of these measures may have run their course, the state is only now beginning to feel the full impact of others, such as the suspension of net operating loss deductions.”

During the 2012 tax year – the first year since the recession most corporations could use an operating loss deduction – the analyst estimates $30 billion in losses were written off against profits.

During the 2012 tax year – the first year since the recession most corporations could use an operating loss deduction – the analyst estimates $30 billion in losses were written off against profits.

The analyst’s conclusion cannot be confirmed because the Franchise Tax Board hasn’t completed its review of the 2012 tax year.

Businesses also will be claiming more tax credits to offset income, the analyst says. About $3 billion worth in the 2013 tax year is the prediction.

Perhaps the chief culprit in tamping down business tax collections was allowing corporations in the 2012 and 2011 tax years to choose the most generous formula for themselves in determining how much they owed in California taxes.

“We tentatively estimate that this reduced the (corporate tax) base by about 13 percent in 2011 and 2012,” the analyst says.

All of which contributes to the virtual crapshoot faced by the analyst and Brown’s Department of Finance in predicting what the next tax year will bring.

“It’s getting increasingly difficult to forecast the corporate tax given all of the tax policy changes that have been made over the past decade,” said Michael Cohen, Brown’s finance director, in unveiling the Democratic  governor’s new spending blueprint on January 9.

governor’s new spending blueprint on January 9.

Says the analyst:

“In the near term, it is easy to imagine actual annual revenues for this tax being hundreds of millions of dollars higher or lower than our forecast in any given year.”

There’s a significant downside to this uncertainty. An example highlighted by Brown in his budget is the latest estimate of the fiscal impact of Proposition 39, the voter-approved 2012 initiative that ended the ability of major corporations to choose the formula they wanted when calculating state taxes.

Based on 2010 returns processed by the Franchise Tax Board, voters were told Proposition 39 would net the state $1 billion in corporate tax revenue annually.

But after examining 2011 returns, the tax board lowered its estimate to $675 million for this year and $726 million for the upcoming fiscal year, drops of 33 percent and 28 percent respectively.

Different groups tend to focus on different factors for the sluggish collections.

Business taxes are Swiss-cheesed with loopholes allowing corporations to skirt their full tax liability is a common complaint of unions, particularly those for public sector employees.

Business taxes are Swiss-cheesed with loopholes allowing corporations to skirt their full tax liability is a common complaint of unions, particularly those for public sector employees.

The largest deduction for businesses is the ability to write off current profits against losses from previous years, followed closely by credits for research and development costs.

When lawmakers and Schwarzenegger suspended the operating loss write-off for tax years 2010 and 2011 to help the state’s cash-starved general fund, it represented an increase in revenue of more than $1.6 billion over the two tax years.

The Legislative Analyst noted at the time, however, that beginning in the 2012 tax year, the state would begin losing money when the write-offs could be used again. For the budget year beginning July 1, 2012 the analyst predicted a loss of $205 million.

Research and development credits cost the state general fund roughly $1 billion each year, relatively small compared to California’s biggest tax breaks, neither of which are found in state corporate tax law.

Allowing homeowners to deduct mortgage interest costs $4.3 billion. The sales tax exemption on purchases of food, gas, electricity and prescription drugs is about $7.8 billion.

Employers and business interests counter that despite being able to subtract their losses and other costs like research California’s inhospitable regulatory and tax climate inhibits greater profits.

They argue fewer taxes would improve productivity and routinely call for additional credits.

In his budget, the Democratic governor takes the long view:

“From 1943 through 1985, corporation tax liability as a percentage of profits closely tracked the corporation tax rate. Since 1986, increasing S?corporation activity and use of credits have been contributing to a divergence between profits and tax liability growth. Businesses that elect to form as S?corporations pay a reduced corporate rate, with the income and tax liability on that income passed through to owners and thus shifted to the personal income tax.”

Looking at business tax receipts for the past decade, the decline and its causes is pretty clear cut.

In 2005, business taxes paid were $12.4 billion and still hovered above $10 billion even as the state collapsed into recession in 2008.

In the 2008 budget, Schwarzenegger and lawmakers advanced revenue to the cash-starved state by requiring taxpayers to remit 30 percent of their annual estimated payments in April and another 30 percent in June instead of the previous method of 25 percent each quarter.

The same budget imposed a hefty 20 percent penalty for businesses that underpaid their taxes by $1 million or more. Businesses could avoid the penalty by filing an amended claim for previous tax years going back to 2003 by May 31, 2009.

Budget writers assumed enough firms would avail themselves of the amnesty that the state would pocket an additional $1.4 billion.

Lawmakers and the GOP governor reckoned that in future years corporate tax payments also would be larger as businesses erred on the side of overpayment to avoid the penalty.

Coupled with the ban on operating loss write-offs, those changes helped spike tax collections to $12.2 billion in 2009.

But as other big-ticket changes kicked in, like corporations being able to pick the least onerous tax formula, receipts fell to under $10 billion by 2011 and then to $8 billion for the fiscal year that ended June 30, 2012.

Even the underpayment penalty is boomeranging back on the state.

Even the underpayment penalty is boomeranging back on the state.

Corporate tax payments fell short of estimates in June 2012 because refunds were $93 million higher than the $67 million expected.

Brown reports in his budget for the upcoming fiscal year that corporation taxes are down in part because of a “continuing trend toward large refunds related to the resolution of taxpayer disputes from prior years.”

The Franchise Tax Board estimates it could pay out $600 million in prior year refunds by June 30 – many of them stemming from large corporations overpaying their taxes to avoid the 20 percent penalty.

“Our forecast assumes that this trend of refunds will continue,” Brown says.

That seems to be about the only thing state budget writers are willing to predict with certainty – except that there’ll be more uncertainty.

“Major changes in business tax policy … have drastically changed the relationships between economic and tax data,” the analyst says. “It may take several years before data is available to help us address these forecasting (issues).”

-30-

Filed under: Budget and Economy

- Capitol Cliches (16)

- Conversational Currency (3)

- Great Moments in Capitol History (4)

- News (1,288)

- Budget and Economy (383)

- California History (139)

- Demographics (11)

- Fundraising (74)

- Governor (122)

- Legislature/Legislation (270)

- Politics (173)

- State Agencies (38)

- Opinionation (36)

- Overheard (246)

- Today's Latin Lesson (45)

- Restaurant Raconteur (21)

- Spotlight (110)

- Trip to Tokyo (8)

- Venting (184)

- Warren Buffett (43)

- Welcome (1)

- Words That Aren't Heard in Committee Enough (11)

No Comments »

No comments yet.

RSS feed for comments on this post.

Leave a comment