A State Refund Coming Back? Here’s 15 Places to Donate Some of It

It’s tax ciphering crunch time.

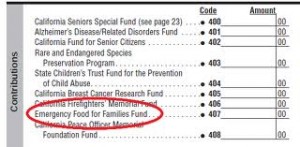

If there’s a potential refund coming, the state has created 15 options to donate some of that cash to various causes.

There’s one new tax check-off for 2011 to be found on Page 3 of the Franchise Tax Board’s Form 540. It’s a fund to help child victims of human trafficking.

The voluntary contributions — there’s a $1 minimum — are tax deductible.

Several of the 15 current check-offs were supposed to vanish from the list for the 2011 tax year but were revived through legislation.

The state places a maximum of 15 on the number of check-offs. New ones must wait their turn until existing check-offs expire or are removed for failing to garner the minimum level of taxpayer contributions needed to maintain a spot on the list, usually at least $250,000.

Contributions to current check-offs are logged by the tax board which also maintains a list of those that have expired or been repealed.

Last tax year, 2010, the Amyotrophic Lateral Sclerosis – ALS – Lou Gehrig’s Disease Research Fund was required to have contributions of at least $250,000 to keep its place. It only received $114,051.

But Sen. Juan Vargas, a San Diego Democrat running for Congress this year, carried legislation to restore the ALS check-off to the list.

The Municipal Shelter Spay-Neuter Fund received only $194,462 of the $250,000 it needed last year to stay on the list but Assemblyman Cameron Smyth, a Santa Clarita Republican, carried legislation to put the fund back on.

Under the terms of the bills – signed into law by Gov. Jerry Brown – neither fund must reach a minimum level of contributions this year to keep their place.

That’s the usual rule for check-offs in their first year but, the next year, a minimum of $250,000 must be reached.

So far this year, Californians have contributed $18,269 to the Lou Gehrig Fund and $40,146 to the Spay-Neuter Fund.

The child victim of human trafficking fund, which also has no minimum to meet this year, has received $4,264 in contributions.

This is the second year a check-off for the California Arts Council is on Page 3 of the Form 540.

This is the second year a check-off for the California Arts Council is on Page 3 of the Form 540.

Last year, taxpayers gave the council $164,298. This year it must reach $250,000 or lose its place or convince the governor and Legislature it should still be renewed for another year or more.

“The tax check-off for the arts program gives most Californians an easy and very direct way to improve arts and cultural programs in the state,” said Craig Watson, the director of the arts council in a statement.

“Even small donations add up in ways that help keep the arts alive in our schools and local communities.”

Also facing its first $250,000 threshold is a fund benefiting the California Police Activities League. Last year, it received just $69,431 in contributions.

Legislation last year also extended the lifespan of two veteran funds – the Rare and Endangered Species Preservation program and the State Children’s Trust for the prevention of Child Abuse.

Created in 1983, both were supposed to end after the conclusion of the 2012 tax year — January 1, 2013. Now they’ll stay on tax forms through the 2017 tax year, if they meet their annual minimums.

Each must receive at least $313,582. Neither has had trouble exceeding their minimums in past years. The endangered species fund raked in over $605,000 last year while the children’s fund had contributions of over $409,000.

No lawmakers came to the relief of the the California Military Family Relief Fund which needed contributions of $279,374 last year to remain on state tax forms. It received $202,010 and lost its place.

Also dropping off the check-off list was research into ovarian cancer. It received $121,427 last year – less than half the $250,000 it needed.

Those cancellations made room for the Arts Council and Police Activities League as well as check-offs benefiting the California Veterans Homes and publicizing the ability of new parents to safely surrender unwanted infants.

Among the other canceled or expired check-offs are ones dealing with lupus, colorectal cancer, the state military museum and preservation of California’s historic missions.

At more than $605,00 the endangered species fund received the most contributions last year followed by the Emergency Food for Families  Fund with $598,157. Money going into food fund is used to buy goods and deliver them to food banks and soup kitchens around the state.

Fund with $598,157. Money going into food fund is used to buy goods and deliver them to food banks and soup kitchens around the state.

Created in 1975 by Jerry Brown in his first term of office, the 11-member arts council is charged with promoting arts in California.

Its budget has been reduced by some 80 percent since the fiscal year that ended June 30, 2002.

A $1 contriubution from every taxpayer would generate $15 million for the arts, the council notes.

-30-

Filed under: Budget and Economy

- Capitol Cliches (16)

- Conversational Currency (3)

- Great Moments in Capitol History (4)

- News (1,288)

- Budget and Economy (383)

- California History (139)

- Demographics (11)

- Fundraising (74)

- Governor (122)

- Legislature/Legislation (270)

- Politics (173)

- State Agencies (38)

- Opinionation (36)

- Overheard (246)

- Today's Latin Lesson (45)

- Restaurant Raconteur (21)

- Spotlight (110)

- Trip to Tokyo (8)

- Venting (184)

- Warren Buffett (43)

- Welcome (1)

- Words That Aren't Heard in Committee Enough (11)

No Comments »

No comments yet.

RSS feed for comments on this post.

Leave a comment